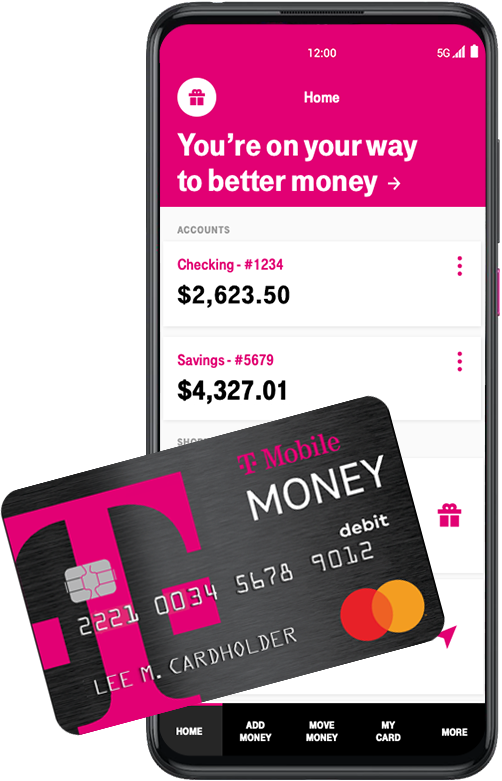

How APY works: Checking account customers earn 4.00%

annual percentage yield (APY) on balances up to and including $3,000 in your Checking

account per month when: 1) you are enrolled in a qualifying T‑Mobile or Metro by

T‑Mobile plan; 2) you have registered for perks with your T‑Mobile ID; and 3)

at least 10 qualifying transactions using your T‑Mobile MONEY card and/or instant

payments to friends have posted to your Checking account before the last business day of the

month. Qualifying transactions posting on or after the last business day of the month count

toward the next month’s qualifying transactions. The first time you fund your account, as an

additional added value, you will receive 4.00% APY on balances up to and including $3,000 in

the statement cycle in which you make your first deposit of greater than $1, as well as in

the cycle that follows that deposit provided all other requirements are met. These added

value benefits are subject to change. Balances above $3,000 in the Checking account earn

2.50% APY. The APY for this tier will range from 4.00% to 3.40% depending on the balance in

the account (calculation based on a $5,000 average daily balance). Customers who do not

qualify for the 4.00% APY will earn 2.50% APY on all Checking account balances for any

month(s) in which they do not meet the requirements listed above.

Savings account

customers earn 2.50% annual percentage yield (APY) on all Savings account

balances per month. You must have a T‑Mobile MONEY Checking account that is in good

standing and has been funded to open a Savings account. APYs are accurate as of 12/01/22 but

may change at any time at our discretion. Fees may reduce earnings. For more information,

see

Account Disclosures

/ Terms and Conditions or go to our

FAQs.

Get paid up to 2 days early with direct deposit: Subject to description and

timing of the employer payroll-based direct deposit, we typically make funds available the

business day received, which may be up to 2 days earlier than scheduled.